Indian Spices Market Report- February 2021

Crop & Market Scenario

- Demand from export markets, primarily Bangladesh and China, have started picking up. There is also an increase in domestic demand for the new crop

- Stocks at cold stores have depleted quickly in the last 4 months. The current stock at Guntur was at 14 lakh bags of 40 Kg net. Total stock across trading centers is expected to be around 0.32 Crore bags of 30-35 Kg net

- The growing area has increased between 15 - 20% vs last year in AP & Telangana and 20 - 25% in Karnataka

- Crop is at fruit ripening to harvesting stage in major growing states of Andhra, Telangana and Karnataka. Harvest of hybrid varieties started in the 3rd week of Jan

- 40% of the crop was harvested in traditional belts of the Byadagi area. Arrivals at Byadagi market are expected to increase by the 3rd week of Feb’21 onwards

- Major arrivals across regions are expected to start from the 3rd week of Feb onwards. Productivity needs to be monitored, considering the staggered sowings

- Virus infestation in some areas of Andhra & Telangana is a concern at this point of time, as it may bring down the yields. We need to watch the impact in the next 20 days

- Crop in Tamil Nadu is mostly at fruiting to ripening stage. Harvest is expected to start the last week of Feb and will arrive in markets by the 2nd week of March

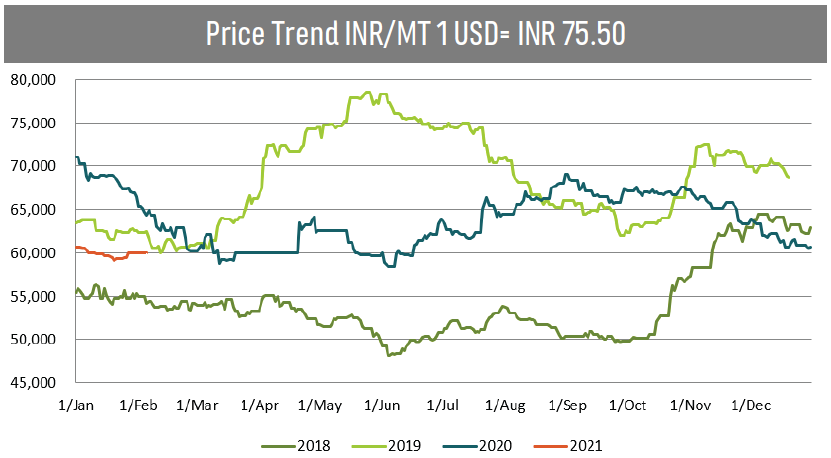

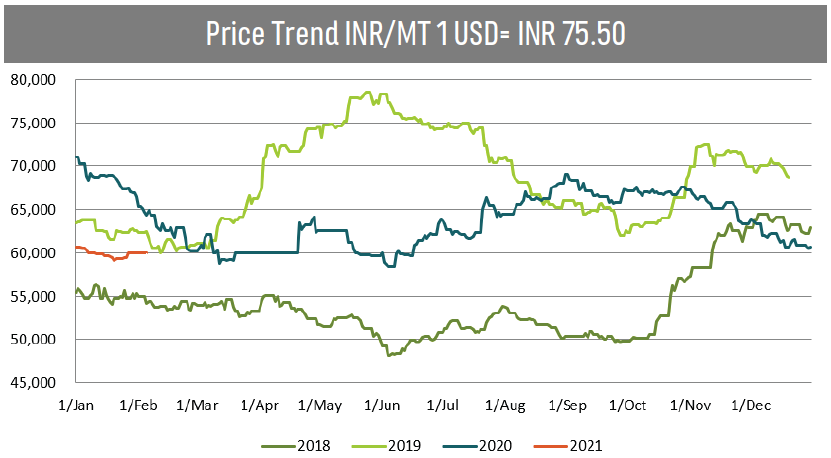

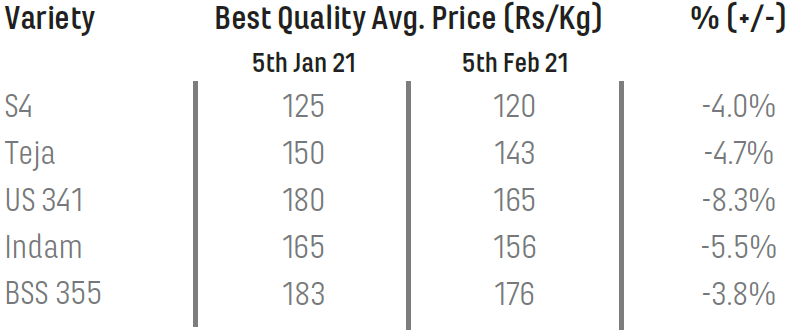

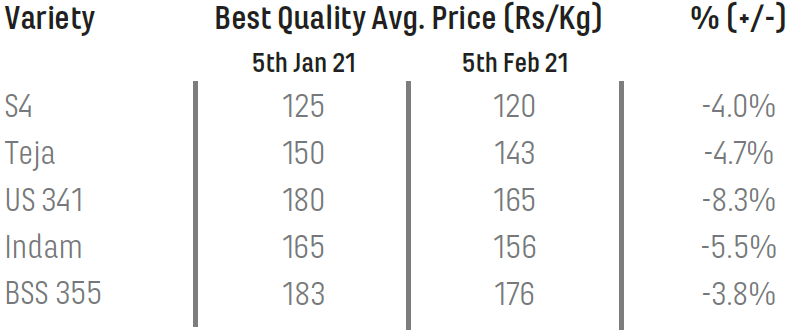

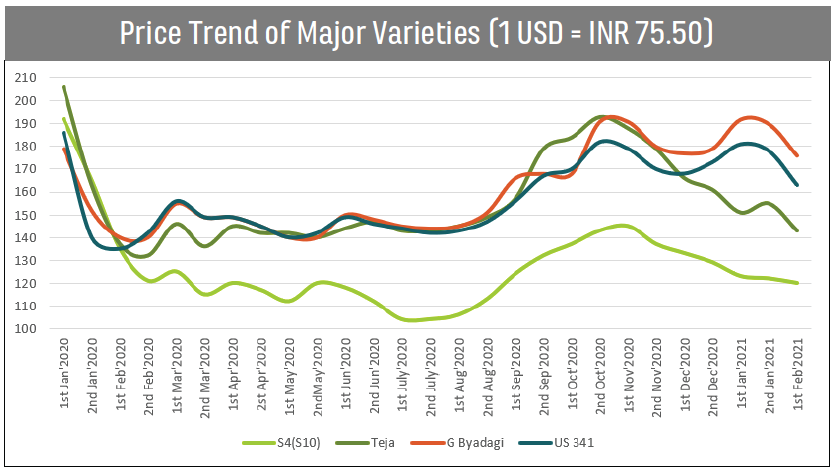

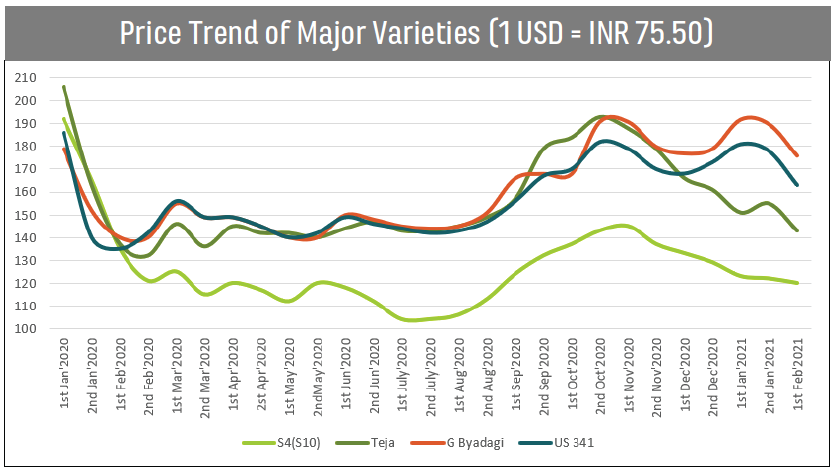

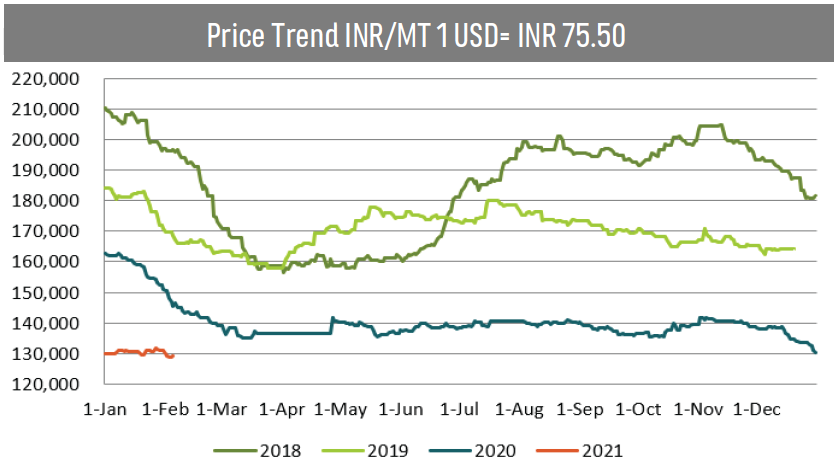

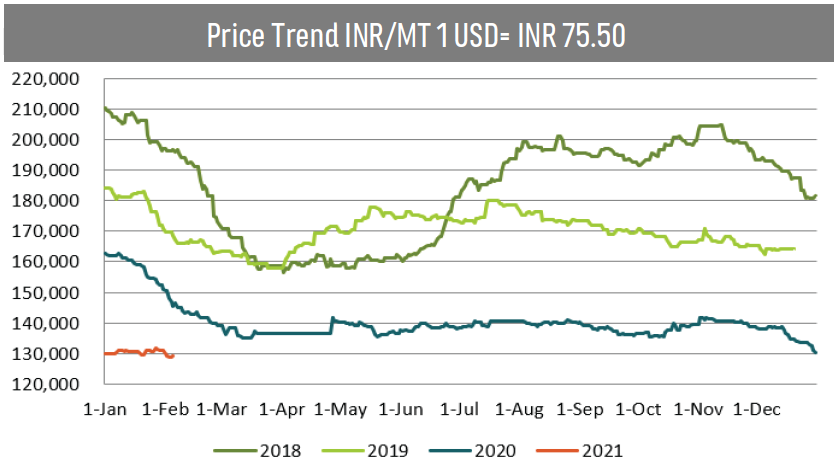

Major Varieties Price Trend - Guntur Market

Factors to Watch

- Export and domestic market demand

- Virus infestation and impact on yields

- New crop arrivals

- Stockist activity

Near Term View

Prices are expected to soften in the short term, considering the new crop arrivals and stock levels in cold storage

Crop & Market Scenario

- The expected yield loss and crop disease cases reported across some of the growing regions in Maharashtra and Telangana have triggered aggressive buying interest across major markets

- Prices moved up >15% from early last month’s traded price range

- New arrivals are expected to be in full swing by the end of March ‘21

- Renewed buying interest from export and domestic segment against delay in new arrivals are also factors in the current bullish price trend

Disease affected turmeric field in Maharashtra

Near Term View

- Prices are likely to be firm until March. Expected crop arrival delays may support the current price levels

Crop & Market Scenario

- Good carry out stock this year compared to last 4 years

- Overall acreage is down compared to the previous year, as farmers have switched to alternate crops

- Yields are expected to be marginally lower compared to LY due to unfavorable weather impacting the crop growth in some of the regions. Weather conditions during next few weeks will be critical for the crop

- Conventional cumin prices have been stable

- EU pesticide compliant cumin availability is limited

Cumin crop at 75 days old

Crop & Market Scenario

- Coriander carry out stock this year is less than it has been in the last three years

- Overall acreage is almost the same as last year

- Prices have been stable during last few weeks and are expected to remain firm

- The domestic demand for the new coriander crop is expected to be strong this year

Coriander crop at 80 days